New Zealand is currently in a period of uncertainty when it comes to the financial future. Interest rates and inflation are rising, house prices are trending down, every news outlet is talking about a looming recession and the upcoming “mortgage shock”. This can create feelings of uncertainty and overwhelm for many clinic owners who rely on the cashflow availability of their patients and clients to not just make a profit but manage their weekly business expenses.

While there is countless information about what a recession could mean for you as a business owner, there’s a small but powerful action you can take today to support your business through any potential recessions or reduced cash flow availability: accepting HealthNow’s employer aid payments and utilising their medical-focused buy now pay later platform. Here’s how.

Health Accessibility Already Has A Problem

Before diving into any predictions of what the health service utilisation scene may look like in the coming months, it’s important to acknowledge the state of New Zealand’s current landscape: 39% of New Zealanders continue to avoid visiting their GP when they have a genuine medical need due to the upfront appointment fee.

While community services cards help reduce the rate for low-income families, the $19.50 fee still leaves many struggling to afford the upfront expense, or falling into the 5% to 25% that fail to subsequently collect their prescription medication due to the copayment fee.

This reality is damaging to both people and clinics: delayed healthcare access leads to longer recoveries and negative health outcomes, while clinics are left with either less bookings, or high administrative costs from having to chase payments, process reconciliations or trying to manually manage instalment payment plans. For some, these tedious processes may even negate the value of the original debt.

Employer Aid

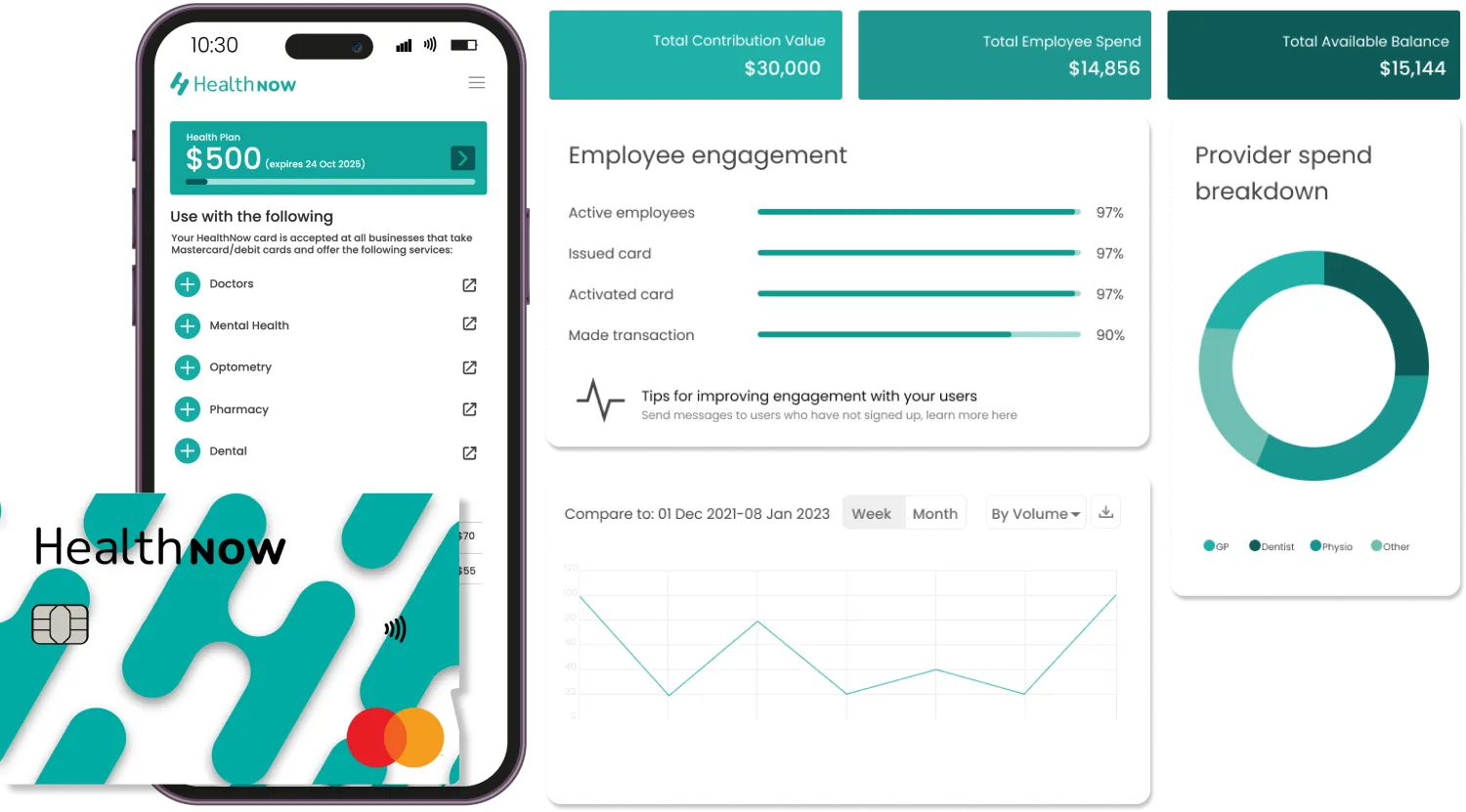

One powerful yet very simple and easy way to support both your clinic and your patients is by registering to accept HealthNow’s employer aid payments. Employer aid has significantly grown in popularity over the past 12 months, with many businesses and large corporations choosing to invest into the health of their staff through depositing funds directly into their dedicated health wallets. This gives employees full control on which health services they choose to access and when, as opposed to contributing a copayment for a private health insurance plan that is often limited, restrictive, and has many exclusions.

Think of the health wallet like a digital bank account located within the HealthNow app that can only be used for health-related services and items, but does have the flexibility to be shared across family members – a significant advantage over other insurance options. Complete a free registration to become a HealthNow provider, and once set up you’ll be able to accept payments from employer aid funds in real time, much like a debit card. Employer aid funds have no expiry date so will be available for health consumers to use at any time, regardless of other financial or economic conditions.

Buy Now, Pay Later

Another way a clinic can continue to support their clients and their own financial viability regardless of what the future financial climate holds is through offering a Buy Now Pay Later service. However, with many BNPL platforms coming under scrutiny over the previous months due to their lack of regulatory compliance, it can’t be just any platform.

HealthNow is the world’s first BNPL platform that is dedicated entirely to the health and medical field, with a vision of making healthcare accessible for everyone the moment they need it – without being held back by the funds immediately available in their bank account. HealthNow also meets a higher level of compliance to ensure it operates with social responsibility in the healthcare sector.

Instead of paying the full cost upfront, health consumers have the option to spread each medical bill into multiple interest-free instalments, over a maximum of twelve weeks, though they choose the exact time period. For health providers offering HealthNow, they get paid in full on the day the services are rendered by HealthNow.

BNPL statistics from other sectors show promising results. Offering BNPL at the point of sale has seen a 30% increase in the likelihood to make a purchase, with an 80% repeat service rate. There is no additional credit card debt racking up interest or affecting credit scores, and healthcare accessibility remains independent from the cash available in transactional accounts.

HealthNow Offers Additional Benefits To Your Clinic

With people at the heart of what they do, HealthNow has other significant benefits for practices and clinic owners. Patient acquisition, retention and optimising the patient experience are consistent goals and challenges of medical practices, and the HealthNow app and online platform support these goals by removing the financial accessibility barrier for new and existing patients, while providing an intuitive and patient-friendly interface that is easy to use.

With 60% of those surveyed by HealthNow already having used a BNPL service, 98% considering healthcare an unplanned “surprise expense” and 100% wanting the option of spreading their healthcare costs if they need to, HealthNow is currently being rolled out across the country with rapid uptake by wellness services, pharmacies and clinics ranging from medical centres to physios and dietitians.

Get Started With HealthNow

Setting your clinic up for HealthNow so you can accept employer aid payments and enable your patients and clients to have a buy now pay later option is free and easy. Simply register your company’s interest via this contact form and a HealthNow team member will get back to you promptly.