Industries across the country are struggling with dire staffing shortages. 93.5% of the 355 New Zealand businesses surveyed are advertising to fill vacancies – and 100% of these are struggling to fill them. With a record-low unemployment rate of 3.1%, job seekers are now being more selective about the roles they want to accept, and this involves considering the attractiveness of the offer with regard to the benefits and incentives above and beyond the salary.

As a result, many employers are now focusing on offering employees what they really want: greater support for mental and physical health. Specifically, in a report by the Employers and Manufacturers Association (EMA), mental and physical health and wellbeing programs were more desirable than a company car, car allowance or onsite parking, budget for a home office, financial support for professional study, share incentives, paying professional membership fees – even paid leave for study. Not coincidentally, 35% of businesses surveyed by EMA recently improved their working practices, including adding to their mental and physical health and wellbeing programmes.

Employees Are Being Offered More Money For Self-Directed Health

While some companies are adding mental health days, contributions to private health insurance or gym memberships and flexible working hours, more businesses are choosing to take a strategic approach to recognise that health and wellness requirements are multifaceted, complex, and extend beyond the immediate employee to their families.

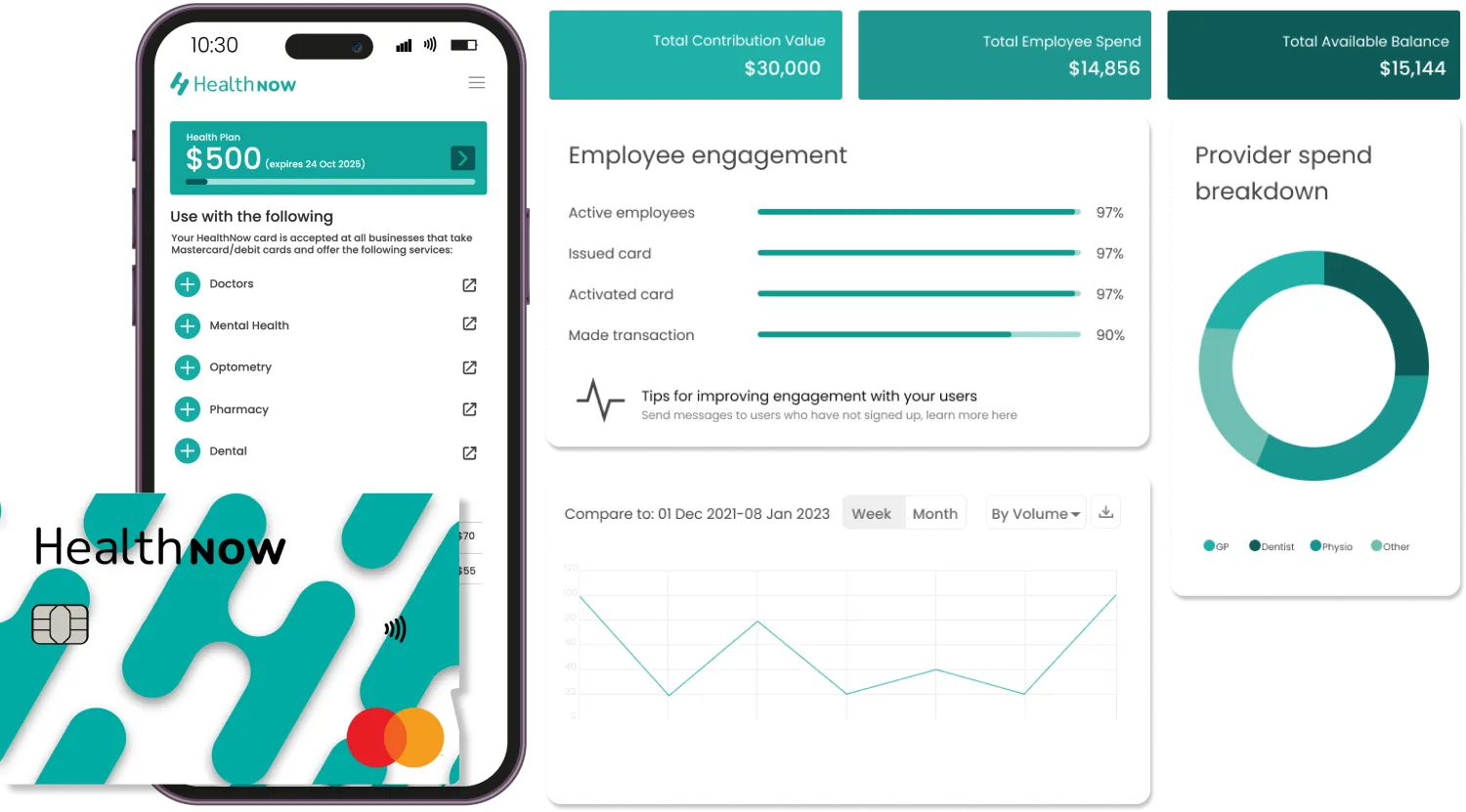

As such, they are choosing to give employees greater control of how the money allocated for their health benefits is used via a dedicated digital health wallet that can be used for a wide range of health services for themselves or their families. The health services are selected entirely by the employee within the parameters the employer sets, and without the funds ever expiring or going unacknowledged or forgotten, as can happen with unclaimed insurance plans.

To an employee, it looks like a regular bank account that shows the funds they have available – except that it can only be used to improve their health.

Can Your Clinic Accept The New Form Of Payment?

With employees now being encouraged to address health concerns early and proactively using these additional funds classed as ‘employer aid’, some New Zealand clinics and pharmacies may miss out. These funds can only be accessed by registered HealthNow providers that carry the operational payment portal. The eligibility for registration is being a health or medical clinic, including allied health services and pharmacies. HealthNow members include:

- Pharmacies

- GP clinics

- Skin check clinics

- Optometrists

- Audiologists

- Osteopaths

- Chiropractors

- Physiotherapists

- Podiatrists

- Nutritionists and dietitians

- Psychologists

- Mental health services

- Dental clinics

- Radiologists

- Dermatologists

- DNA testing services

Accepting employer aid payments is now a simple and streamlined process, with very few technical requirements for your clinic due to HealthNow’s innovative AI technology. If you’re not yet a provider and would like to be, start by following the free and easy sign up process as a health provider.

How To Accept HealthNow Employer Aid Payments

All health wallet holders have the HealthNow app on their smartphone, which is used when it comes time to pay for their health service or product. This is done instantly from the app much like an eftpos card – funds are withdrawn from your patient’s account and you receive instant confirmation that they’ve been successfully passed to your clinic, paying you in full on the day.

As a health provider, you incur minimal fees for each transaction, with full transparency and no surprises. Moreover, you also reap the range of benefits that comes with offering HealthNow as a service, including:

- Attracting more clients – users are able to search for health providers offering the HealthNow payment platform through the app

- Building loyalty through access – allowing clients to see you when they may not have been able to previously afford the upfront costs, thanks to HealthNow’s Buy Now Pay Later (BNPL) functionality.

- Supporting long-term health outcomes – when the stress of upfront cost is removed, users increase the amount they spend on health products and services leading to better long-term health outcomes

- Offering a Buy Now Pay Later (BNPL) alternative for those without employer aid payments – HealthNow first built its reputation by being the world’s first health-specific BNPL platform at no cost to health consumers. This means that clients can access the health services they need and split the cost of the payments over up to six weeks, while the clinic gets paid in full on the day.

Get Started For Free Today

There is no cost to sign up or integrate with HealthNow, and all training and support are completely free with no ongoing subscription or monthly charges. HealthNow also offers a free trial period so you can ensure it’s easy and simple to use, and right for your team.